– by New Deal democrat

Client costs in June failed to point out any inflation in any respect for the second month in a row, as they declined -0.1% following an unchanged studying in Might. On a YoY foundation inflation decelerated -0.3% to three.0% (technically 2.98% in the event you exit one additional decimal level), the bottom YoY improve since March 2021.

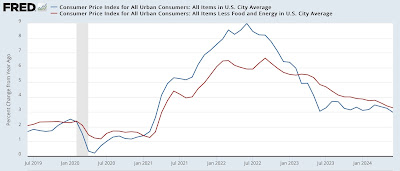

For the report, “core” inflatioin much less meals and power elevated 0.1%, the bottom month-to-month improve since January 2021. On a YoY foundation it was greater by 3.3%, the bottom since April 2021. Right here is the YoY% change in each headline (blue) vs. “core” (purple) inflation:

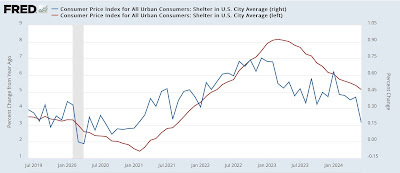

As normal, the value of gasoline and the imputed value of shelter have been the first elements, as power declined -2.0% for the month, whereas shelter elevated 0.2%, the bottom month-to-month improve in that element since February 2021. Listed here are the month-to-month (blue, proper scale) and YoY (purple, left scale) % adjustments within the shelter index:

On a YoY foundation, imputed shelter inflation was 5.1%, the bottom since March 2022.

Shelter has continued to behave simply as I anticipated. Right here is an replace to the 12-18 month main relationship between home costs (as measured by the FHFA) and House owners’ Equal Hire within the CPI:

Home costs are at the moment growing a bit greater than their common pre-pandemic fee (as a result of, paradoxically, the Fed’s fee hikes have exacerbated a scarcity in housing provide, thereby driving up its value), which has translated to OER and the opposite measures of shelter inflation to proceed to decelerate YoY, however at a a lot slower tempo than their preliminary speedy decline. I count on this development to proceed within the coming months.

Once we strip out shelter, all different gadgets declined -0.1% for the month, once more after being unchanged in Might, and are solely up 1.8% YoY – the 14th month in a row they’ve been up lower than 2.5% YoY:

In different phrases, correctly measured, inflation continues to not be an issue in any respect.

Earlier than I end, let’s take an up to date have a look at our latest and former downside kids, beginning with new and used automobile costs. The previous have been unchanged in June – the tenth time in 11 months they have been unchanged or really declined, whereas the latter declined one other -1.5%. On a YoY foundation each are in outright deflation, as new automobile costs are down -0.9% and used automobile costs are down -9.5%:

Since simply earlier than the pandemic, new automobile costs are up 20.4% and used automobile costs are up 27.2%. In the meantime common hourly wages for nonsupervisory personnel are up 25.7%:

Whereas automobile costs should appear surprising, the very fact is that wages have nearly utterly caught up.

Right here’s what occurred with the remaining downside areas of inflation:

(1) meals away from residence, which peaked at 8.8% YoY over one 12 months in the past, elevated 0.4% once more in June, and elevated 0.1% (really 0.03% one decimal level additional) on a YoY foundation to 4.1% i, vs. its pre-pandemic common of two.5%-3.0%:

(2) electrical energy, which had adopted fuel costs greater, seems to be beginning to comply with them decrease, declining -0.7% in June, and has decelerated to a 4.4% YoY achieve:

(3) transportation companies – primarily automobile repairs (up 0.2% for the month, however down from its peak of. 14.2% YoY in January 2023 to six.0%) and insurance coverage (up 0.8% for the month and up 19.5% YoY – nonetheless down from April’s 22.6% YoY achieve) – declined-0.5% for the second month in a row. It had rocketed from its pre-pandemic vary of two.5%-5.0% to as excessive as 15.2% in October 2022, however has since decelerated to a achieve of 9.2% YoY:

Primarily based on the previous inflationary interval of 1966-82, it’s clear that transportation companies lags will increase in automobile costs by 1-2 years and much more, generally growing proper by means of recessions.

To sum up: apart from shelter and transportation companies, *no* sub-sector of costs was up greater than 4.4% YoY. Many measures, together with headline and core measures, made new 3 12 months lows YoY. And inflation ex-shelter continued properly beneath management.

On closing essential remark: the Fed tolerated plenty of years the place inflation was as much as 1% beneath its goal of two% with full equanimity. Now that YoY inflation is marginally beneath 3%, a Fed with symmetric preferences could be equally snug, and open to decreasing charges. The suspicion earlier than the pandemic was at all times that the Fed handled 2% inflation extra as a ceiling than a goal. Given latest indicators of weakening in some sectors, and the truth that Fed coverage takes a very long time to achieve full impact, my private opinion is that this report offers the Fed has the quilt it wants, if it selected to, to decrease charges at its assembly later this month. If it doesn’t, that means that its preferences are actually uneven – and within the extra harmful deflationary course.

March client value inflation was nonetheless primarily concerning the dynamics of shelter and fuel costs, Indignant Bear by New Deal democrat