One other tackle Housing and Provide of Housing by Skanda Amarnath on the well-known Make use of America. This follows or leads what New Deal democrat has been discussing at Indignant Bear weblog right here, right here, and right here.

After we purchased into our single-family house, I used to be capable of lock in a 2.6% 30 yr mortgage. At this time limit 50% of my mortgage cost goes to principal. The town we live-in is constructing residences like they by no means existed earlier than. The housing will likely be there ultimately. Nevertheless, the street infrastructure doesn’t exist to assist an inflow of individuals.

For the reason that state is operating a deficit, it has delayed the constructing on a street out and in of town which is short-term pondering. The state has delay the construct for five years. By no means thoughts the dearth of infrastructure, the constructing of residences in huge numbers continues. The only house construct continues too.

The Fed’s Different Provide-Facet Dilemma: At the moment’s Restrictive Insurance policies Are Deteriorating Tomorrow’s Housing Provide Outlook

by Skanda Amarnath,

At the moment’s information largely confirmed what we’ve recognized for a while now: the Fed’s restrictive insurance policies are proscribing the extent and development of homebuilding exercise within the US economic system. However once we suppose holistically concerning the relevance of homebuilding to cost stability, the restrictive results of Fed coverage lengthen past demand. Additionally they curtail the outlook for future provide and stoke future value stability threat within the course of.

Most Fed discussions of supply-side dynamics are within the context of disentangling realized inflation. Much less consideration is given to how interest-rate-sensitive the provision facet could be at any time limit (see Drechsler, Savov, Schnabl). Discussions middle on the Fed responding solely to demand-side inflation. It’s taken without any consideration the Fed primarily or solely shapes demand-side outcomes. Actuality is murkier.

Essentially the most inflation-relevant segments of the supply-side can range over time, and so can also the favored monetary constructions for investing in capability to deal with these segments. Not less than because it pertains to housing, which nonetheless drives many of the overshoot of the Fed’s 2% inflation goal, the stance of Fed coverage and the extent of financing prices matter, considerably.

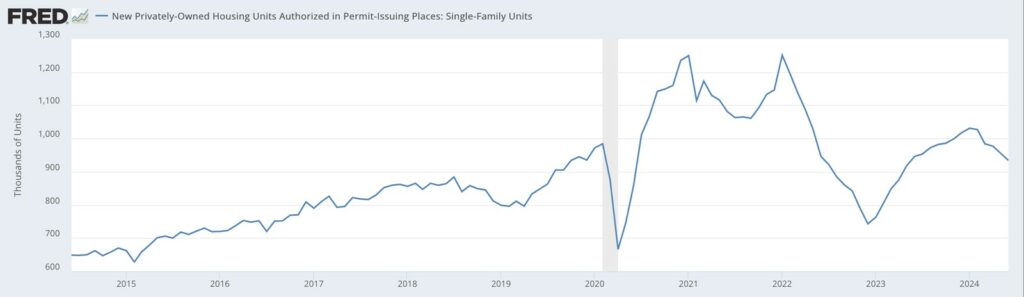

Proper now we’re seeing moderately broad slowing in allowing exercise tied to housing. Single-family models are typically essentially the most related than multi-family on a dollar-weighted foundation, include decrease time-to-build, and are much less noisy to watch month-to-month. Whereas there are native spots of energy and weak point, permits are considerably decrease than their trajectory and degree on the time the Fed started embarking on charge hikes in early 2022.

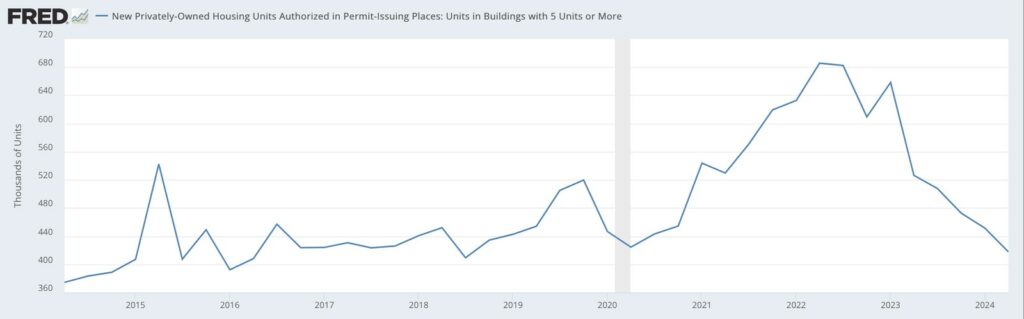

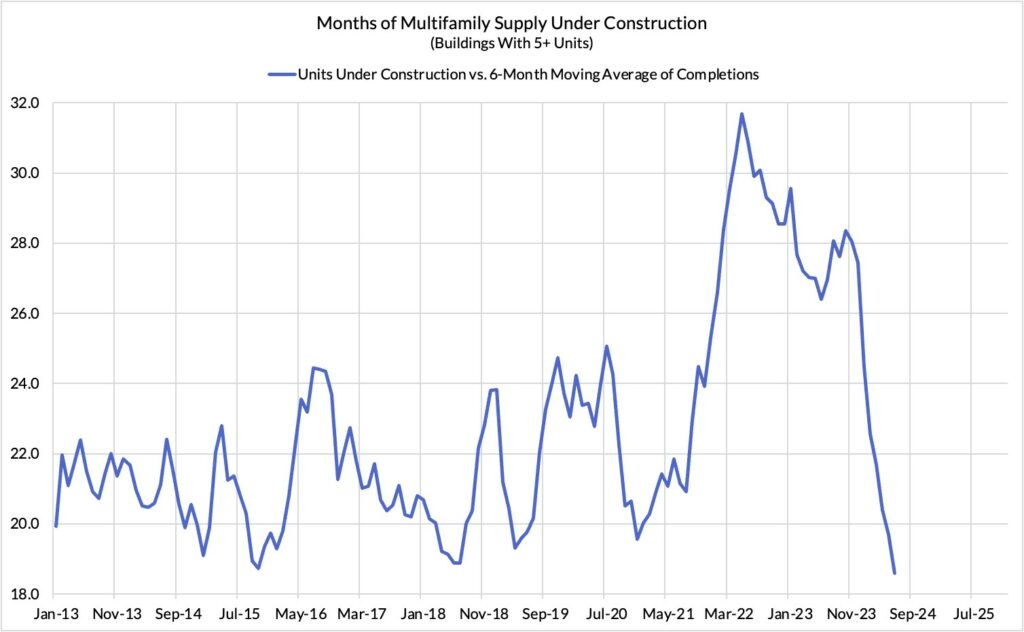

Multifamily permits are noisier however are extra related to what the rental provide image seems like over time (single household leases are a rising share of the tenant occupied housing inventory however nonetheless symbolize a minority). quarterly averages, we see the same image, with permitted models in yet-to-be-built multifamily buildings additionally falling after the Fed started elevating charges and financing prices for the reason that starting of 2022.

It’s price noting that there’s a considerably longer time-to-build related to the typical and median multifamily constructing venture, taking at the very least over a yr if not two or three from the time of allow to the time of completion and supply.

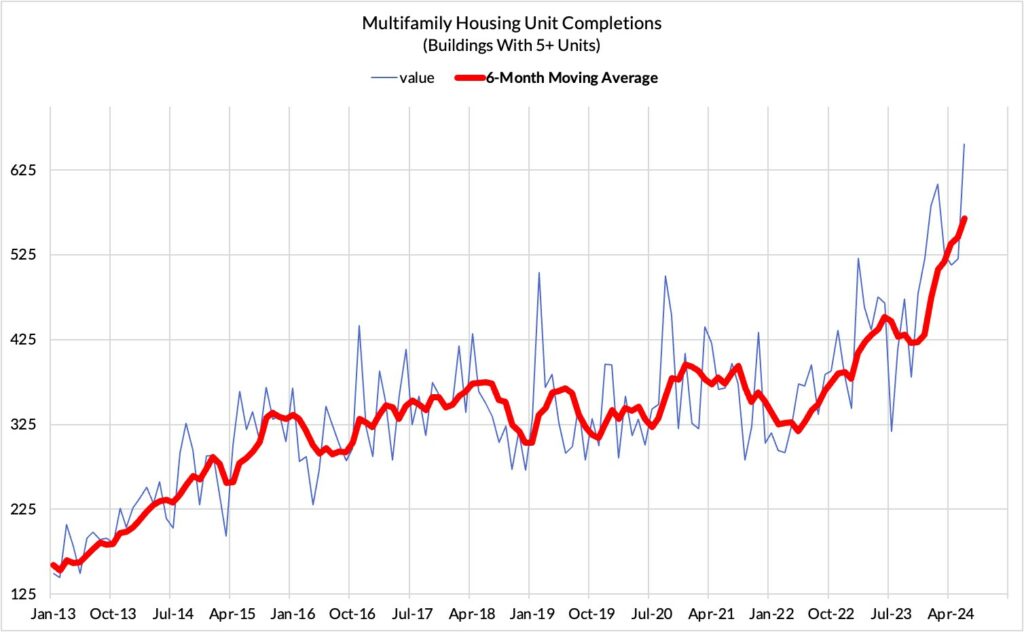

It’s with this perception that we are able to unpack a extremely essential level: a lot of the housing inflation reduction we’re seeing right this moment is paradoxically the results of the surge in multifamily allowing and constructing exercise that largely preceded the Fed’s mountaineering cycle.

We proceed to hit new highs within the completion of multifamily housing models. These are models which can be being delivered to the market and serving to to ship inflationary reduction from the supply-side.

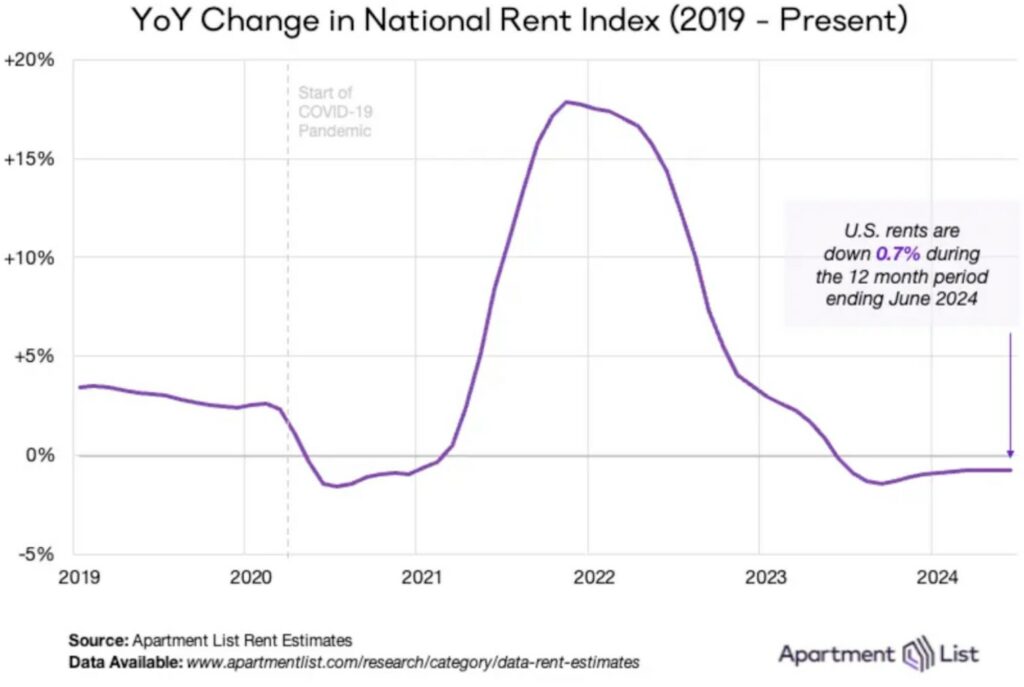

Estimates of market lease for residences and customarily have seen a considerable slowing. Attributable to methodological lags within the official CPI estimates, we’re solely now starting to see this market lease disinflation translate into the Fed’s predominant inflation gauges.

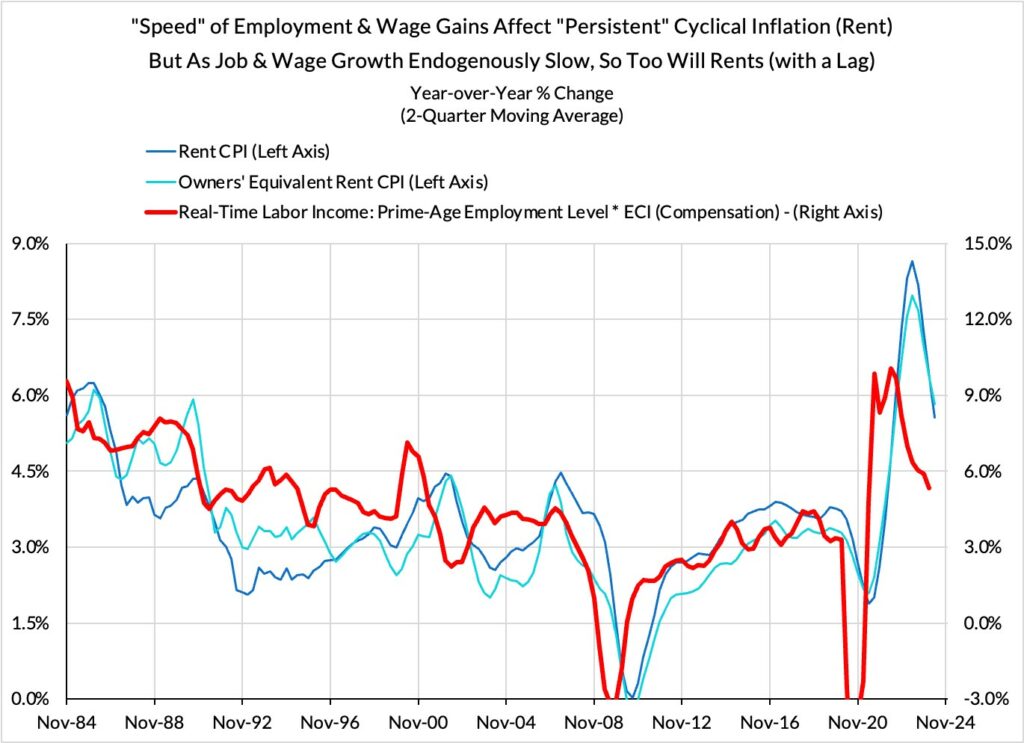

A lot of the market lease slowing can be attributable to a cooling of demand by means of the labor market. In any case, whereas housing provide shortages are considerably structural within the U.S., the native variation of inflation is extra straight attributable to web job development and wage development.

Landlords can cost extra once they count on there to be extra renters and when there’s extra earnings out there from a given renter. However these dynamics don’t exist in a vacuum, impartial of supply-side forces. Within the present market, residences are constructed at a document tempo. A thicker, extra aggressive market can clearly assist test pricing energy.

The difficulty going ahead, and particularly for the Fed, is that the rental provide image doesn’t look so rosy from right here.

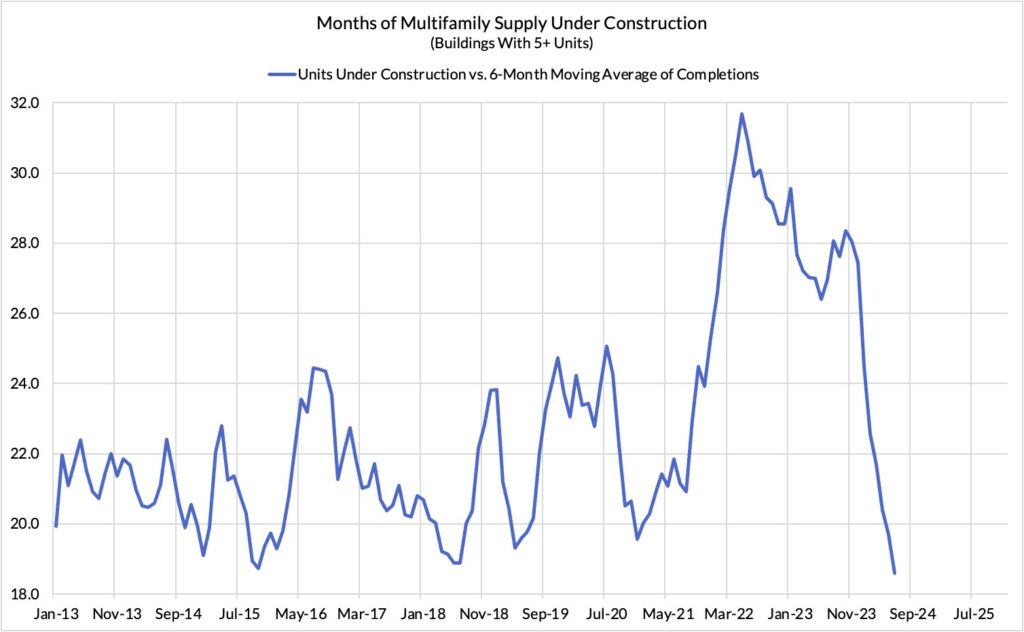

The months of multifamily models’ provide underneath development has fallen from over 30 months down to simply over 18 months. The impact of ever-decreasing permitted models over the previous a number of quarters is just not seen in present completions. It’s seen in completions 1-3 years later. Nevertheless, and seen in decrease models underneath development right this moment.

Ought to the provision image present additional deterioration—as measured by the variety of models underneath development relative to the present capability to finish models—upside dangers to housing CPI and PCE inflation would swell. These housing inflation measures are based mostly on lease information, even when used to proxy house owners’ equal lease.

All of this places the Fed in a extremely awkward place, one during which there aggressively restrictive insurance policies of right this moment have choked off future housing provide and stoked upside dangers to housing inflation 1-3 years ahead.

Thus the causal mechanisms we are likely to harp on are rising no much less related to how the Fed conducts coverage from right here. The Fed has a Congressional mandate to pursue most employment alongside secure costs, however the coverage instruments usually are not of dependable impact on stabilizing costs. And in some substantial situations, their intention to stabilize costs within the right here and now…can as a substitute stoke additional instability sooner or later.

When contemplating the trail to normalization from the Fed’s present coverage stance, it’ll be important to take a richer view of the coverage tradeoffs the Fed faces.