by Invoice McBride

The FDIC launched the Quarterly Banking Profile for Q1 2024:

Reviews from 4,568 industrial banks and financial savings establishments insured by the Federal Deposit Insurance coverage Company (FDIC) report combination internet earnings of $64.2 billion in first quarter 2024, a rise of $28.4 billion (79.5 %) from the prior quarter. A big decline in noninterest expense due to a number of substantial, non-recurring objects acknowledged by massive banks within the prior quarter, in addition to increased noninterest earnings and decrease provision bills this quarter, contributed to the quarterly improve. These and different monetary outcomes for first quarter 2024 are included within the FDIC’s newest Quarterly Banking Profile launched as we speak.

. . .

Asset High quality Metrics Remained Typically Favorable With the Exception of Materials Deterioration in Credit score Card and Industrial Actual Property (CRE) Portfolios: Loans that had been 90 days or extra overdue or in nonaccrual standing elevated to 0.91 % of whole loans, up 5 foundation factors from the prior quarter and 16 foundation factors from the year-ago quarter. The quarterly improve was led by industrial and industrial loans and non-owner-occupied CRE loans. The noncurrent charge for non-owner occupied CRE loans of 1.59 % is now at its highest degree since fourth quarter 2013, pushed by workplace portfolios on the largest banks. Regardless of the current will increase, the trade’s whole noncurrent ratio stays 37 foundation factors beneath the pre-pandemic common of 1.28 %.emphasis added

From the FDIC:

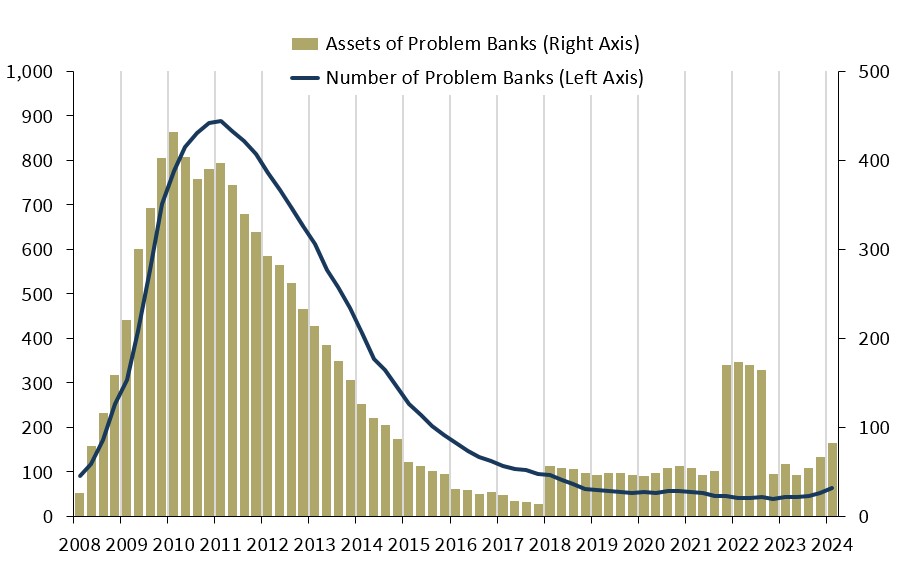

The variety of banks on the FDIC’s “Problem Bank List” elevated from 52 to 63. Complete belongings held by downside banks rose $15.8 billion to $82.1 billion. Downside banks signify 1.4 % of whole banks, which is inside the regular vary for non-crisis durations of 1 to 2 % of all banks.

This graph from the FDIC reveals the variety of downside banks and belongings at downside establishments.

Be aware: The variety of belongings for downside banks elevated considerably again in 2018 when Deutsche Financial institution Belief Firm Americas was added to the listing. A good bigger unknown financial institution was added to the listing in This autumn 2021, nonetheless that financial institution is now off the issue listing.

It seems the current improve in downside banks is expounded to workplace CRE* loans.

*Industrial actual property (CRE) lending contains acquisition, growth, and development (ADC) financing and the financing of income-producing actual property.