I believe the title makes it clear that this will likely be a rambling confused put up. I’m typing on with the thought that one thing is best than nothing and nobody has to learn this.

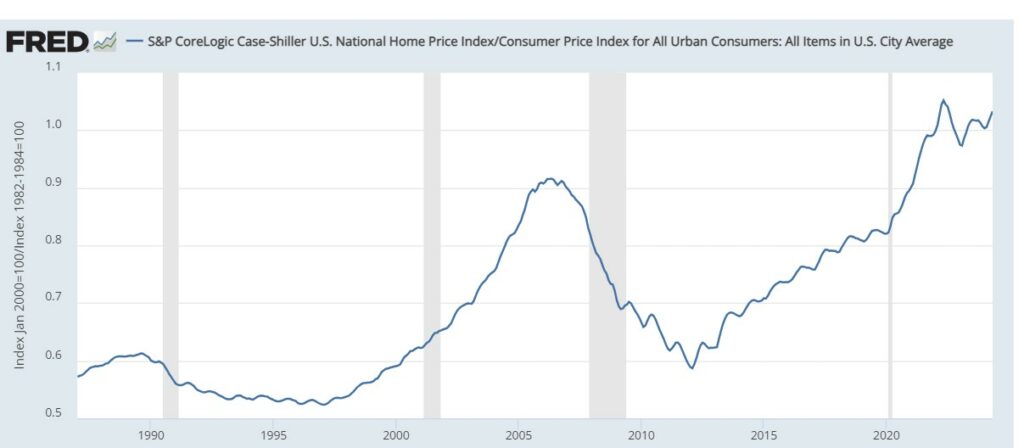

The primary matter – home costs, is in reality one which pursuits me loads. I’ve a regression which suggests {that a} excessive ratio of home costs to the overall worth stage is horrible information, as a result of it signifies a housing bubble which can burst and be adopted by a protracted recession.

At present the ratio of the Case-Shiller housing worth index to the CPI is greater than it was in 2006.

I don’t wish to jinx the economic system (my predictions are nearly at all times mistaken) however I’m not terrified. I believe that this time it’s totally different. This time there has additionally been an enormous enhance in hire additionally relative to the quickly growing basic worth stage. This means that top housing costs are resulting from a real scarcity not hypothesis.

HIgh rents additionally imply that the worth of housing providers is excessive. Individuals paying a excessive down fee and really excessive mortgage funds as a result of mixture of a excessive home worth and excessive mortgage rates of interest have unatractive options. In econospeak the worth of the housing providers they receive is excessive.

I rely extra on vibes than numbers (and I admit it). There aren’t the standard signs of a bubble which embody a whole lot of speak about capital beneficial properties, folks explicitly shopping for planning to promote quickly for a better worth (flip) folks coming into the market who didn’t take part earlier than (the place right here the market is for second houses).

Additionally folks complain in regards to the excessive costs. A excessive worth is dangerous for the customer and good for the vendor, and likewise dangerous for somebody who plans to purchase sooner or later and good for somebody who can promote. I learn in regards to the complaints of determined patrons not the gloating of sellers.

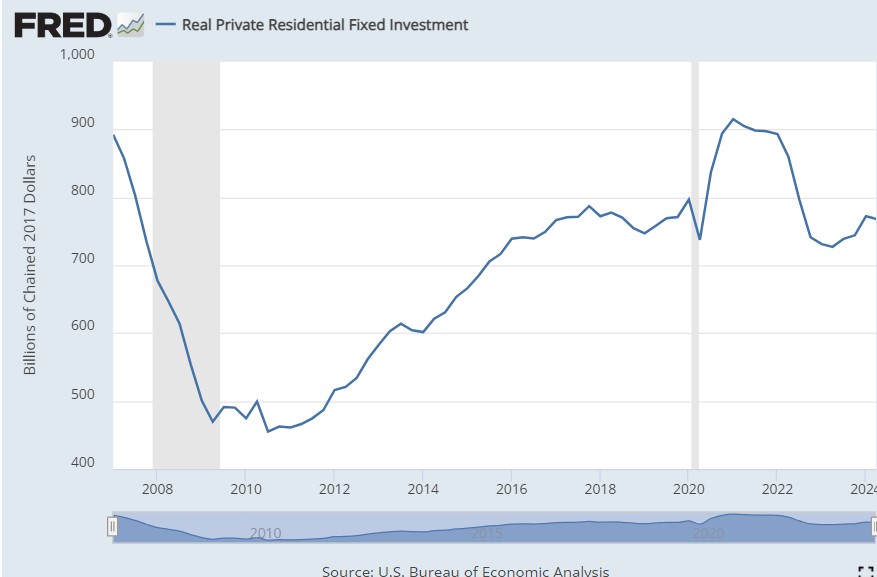

The excessive demand at excessive costs can also be crucial proper now. It means residential funding has remained pretty excessive despite excessive rates of interest (together with the mortgage rate of interest which is the one what issues for housing demand).

This is essential. The principle methods wherein financial coverage impacts the true economic system is thru residential funding which is low if rates of interest are excessive and thru change charges. Given the simultanious shift to tight anti-inflation coverage in wealthy international locations, the best way that the FED’s anti-inflation efforts would have an effect on actual GDP and employment is generally residential funding.

The third channel is funding in non-residentia constructions that are largely workplace constructing and procuring malls (manufacturing unit buildings are massive however low-cost).

However wait, if excessive rates of interest didn’t have an effect on mixture demand, how did they trigger the dramatic decline in inflation? I believe they didn’t. I believe that top inflation was resulting from Covid disruptions and never extraordinarily excessive mixture demand and that it declined though the housing scarcity brought on financial coverage to be ineffective.

That’s I comply with Krugman (as at all times — it’s actually embarrassing) and name the excessive inflation lengthy termporary – one thing that lasted years however was destined to fade away by itself.

Because of this I ascribe the FED’s delicate touchdown triumph to pure luck.

It additionally implies that I hope with some confidence that the touchdown will likely be delicate

(RJW confidence is a really alarming main indicator – I’m nearly at all times mistaken).