QUARTZ The ‘Lock-in Effect’ is Easing. Right here is What It means for the Housing Market

Owners are starting to surrender on ready for decrease mortgage charges. That could possibly be excellent news for potential homebuyers.

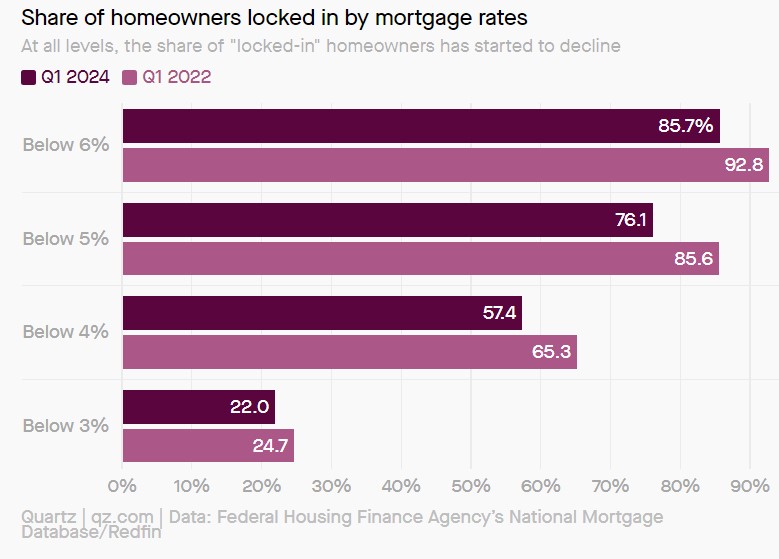

Within the first quarter of this 12 months, six of each seven householders, or 86%, have a mortgage price beneath 6%, in line with a Redfin evaluation of the Federal Housing Finance Company’s Nationwide Mortgage Database revealed Tuesday. That’s down from a report 93% within the second quarter of 2022, an indication that the lock-in impact is easing.

And that’s true at each mortgage price degree. The share of house owners that has held onto their present mortgages has declined previously two years — even for these having fun with charges beneath 3%.

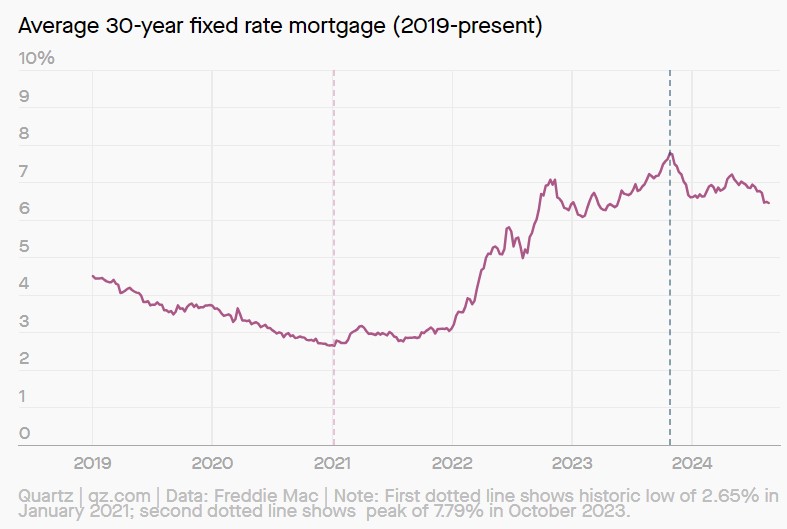

The so-called “lock-in effect” refers to householders electing to remain of their properties to carry onto their decrease mortgage charges after they in any other case may need thought of a transfer. A lot of this was introduced on by traditionally low charges on the top of the pandemic in 2020 and 2021, after they dipped beneath 3%.

Since then, mortgage charges have greater than doubled, driving many householders to remain put in anticipation of decrease charges and a friendlier housing market. The typical rate of interest for a 30-year fastened mortgage is presently 6.46%, in line with the government-sponsored mortgage supplier Freddie Mac (FMCC).

This has left potential homebuyers with fewer and fewer choices. Final month, new listings hit their lowest degree in a 12 months, in line with Redfin (RDFN).

“I have a dozen or so homeowners who would like to sell, but aren’t willing to give up their 3% interest rate for one that’s more than twice as high,” Blakely Minton, a Redfin (RDFN) Premier actual property agent in Philadelphia, mentioned in a press release. “Many of those sellers will list if rates get back down to 5%.”

In consequence, the lock-in impact has contributed to the U.S. housing scarcity, which is estimated to be between 4 and seven million properties. The quick provide can also be pushing up housing costs, which have continued to climb every month. The median sale worth hit $439,455 in July, a 4.1% year-over-year enhance.

This phenomenon seems to be slowly however absolutely loosening its grip available on the market, nonetheless. Increasingly more householders are biting the bullet and giving up their low charges, largely out of necessity, in line with Redfin. Main life occasions, like a job change or divorce, are giving folks no different alternative however to record their properties, no matter charges.

And with mortgage charges lastly beginning to pattern downwards, the “lock-in” impact may ease at a faster tempo than we’ve seen during the last two years. That mentioned, it nonetheless has a methods to go earlier than Individuals really feel comfy taking the leap: Simply 2% of house owners surveyed by Bankrate in June mentioned they’d buy a house this 12 months at a mortgage price of 6% or greater.

In the meantime, 47% mentioned mortgage charges would have to be beneath 5% for them to really feel comfy shopping for a house this 12 months, and 38% mentioned they’re searching for charges beneath 4%.

Whereas many are dreaming of a return to pandemic-era charges, Bankrate chief monetary analyst Greg McBride warned householders to not maintain their breath.

“The hopes for lower interest rates need the reality check that ‘lower’ doesn’t mean we’re going back to 3 percent mortgage rates,” he mentioned.