Fascinating and temporary piece by Dean Baker of CEPR in relation to cost gouging.

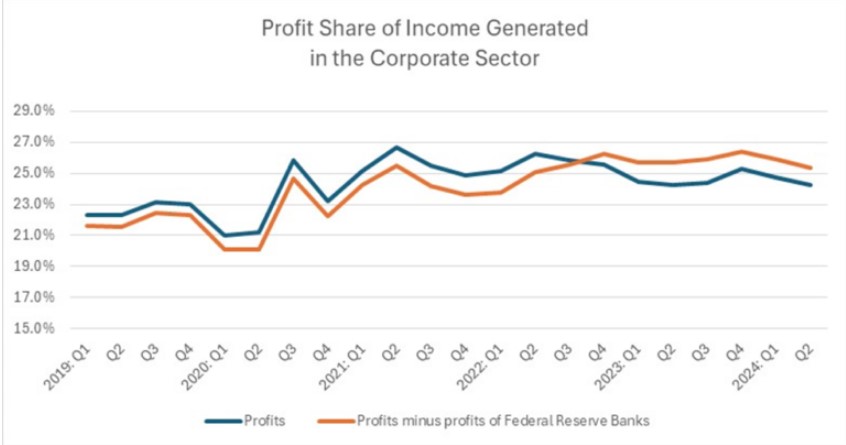

There continues to be a debate in regards to the extent to which “price-gouging” or “greedflation” has been accountable for the rise in costs for the reason that pandemic. We are able to debate the extent to which firms had been in a position to reap the benefits of monopoly energy throughout the pandemic. Regardless of the trigger, it’s clear the revenue share of company revenue has risen from earlier than the pandemic (proven within the graph beneath).

Supply: Bureau of Financial Evaluation.

Within the 4 quarters earlier than the pandemic, the revenue share averaged 22.7 % of the online revenue generated within the company sector.[1] It rose to 26.6 % within the second quarter of 2022. Since then, it fallen again considerably to 24.3 % within the second quarter of 2024.

This measure of income consists of the income earned by the regional Federal Reserve Banks. Since that cash is usually refunded to the Treasury, it arguably shouldn’t be included in a measure of company income.[2] In 2019 the income share averaged 22.0 % of internet revenue, excluding the income of the Federal Reserve Banks. This share peaked at 26.2 % within the fourth quarter of 2022. It has edged all the way down to 25.3 % in the latest quarter. (The regional Federal Reserve Banks are at the moment shedding cash on account of greater rates of interest. The revenue share could be greater when these loses are excluded.)

By both measure the revenue share in the latest quarter is greater than earlier than the pandemic. Utilizing the primary measure, the share has elevated by 1.6 proportion factors from the 4 quarters earlier than the pandemic. By the measure that excludes the income of Federal Reserve Banks, the revenue share has risen by 3.3 proportion factors.

We are able to argue whether or not we wish to describe this shift from labor to capital as “big” or “small.” It clearly doesn’t clarify the majority of the inflation we now have seen for the reason that pandemic. Inflation as measured by the CPI has been 20.9 % for the reason that begin of the pandemic. Meaning the rise in revenue shares, utilizing the measure that excludes income from the Federal Reserve Banks, explains a bit greater than 15 % of the inflation we noticed.

Then again, the impression seems to be significantly extra vital if we evaluate it to actual wage progress over this era. Actual hourly wages have risen simply 1.6 % for the reason that pandemic. If the revenue shares had remained fixed during the last 4 and a half years, wages could be roughly 3.3 % greater than they’re now. This is able to translate into actual wages being roughly 3.3 % greater. That will triple the quantity of actual wage progress we now have seen over this era. (It is a crude calculation, since some objects within the consumption basket, most notably rental housing, should not primarily produced by the company sector.)

In brief, we will debate the dynamics of inflation and the shift from wages to income within the pandemic. However the truth that there was a considerable shift is troublesome to dispute.

There’s one vital qualification to this story. There was an unusually massive statistical discrepancy within the GDP accounts in latest quarters, rising to 2.7 % of GDP within the second quarter of 2024 (NIPA Desk 1.7.5., Line 34). The statistical discrepancy is the hole between GDP as measured on the output aspect and GDP as measured on the revenue aspect.

In precept, these two numbers must be equal. In the identical means we depend folks ranging from the left aspect of the room we must always find yourself with the identical quantity as if we counted folks ranging from the appropriate aspect of the room. As a sensible matter, in a $27 trillion financial system, they are going to by no means come out precisely the identical.

Because it stands, the output aspect measure is significantly greater than the revenue aspect measure. It could end up that with future revisions, the output aspect measure is revised down, and the revenue aspect measure proves to be nearer to the mark.

Nonetheless, it could additionally transform the case that the revenue aspect measure is significantly under-estimated and revised as much as a stage near the output measure. In that case, the stability between income and labor compensation could possibly be affected by future revisions. To take an excessive case, if the complete statistical discrepancy was discovered to be an undercount of labor revenue, then the reported rise within the revenue share would largely disappear.

To be clear, assuming that every one the hole was an undercount on the revenue aspect, and this was in flip completely an undercounting of labor compensation, could be very excessive and unlikely. However you will need to observe that the image might look completely different after we get revisions to the info, each this month and in subsequent years.

Within the meantime, we now have to work with the info we now have. And these information present there was a considerable redistribution from labor to capital within the interval for the reason that pandemic hit.

Addendum: After posting this observe, I noticed I ought to have deducted the income of Federal Reserve Banks from the denominator. This is able to have raised the revenue share in 2019 by 0.1 pp to 22.1 % and lowered in the latest quarter by 0.2 pp to 25.1 %. That will make the rise in revenue shares 3.0 proportion factors as a substitute of three.3 proportion factors.

[1] This calculation takes internet working surplus (income, curiosity, and enterprise transfers), NIPA Desk 1.14, Line 24 over the sum of internet working surplus and labor compensation, NIPA Desk 1.14, Line 20.

[2] The Federal Reserve Financial institution income are from NIPA Desk 6.16D, Line 11.

Sure People, the Revenue Share Has Risen For the reason that Pandemic, CEPR, Dean Baker