– by New Deal democrat

Martin Wolf of the Monetary Occasions has referred to as T—-p’s tariffs “an act of warfare against the entire world.”

Maybe it isn’t shocking that previously week, your complete world has responded. Amongst different issues, per Eric Michael Garcia, “China has suspended exports of a wide range of critical minerals and magnets, threatening to choke off supplies of components central to automakers, aerospace manufacturers, semiconductor companies and military contractors around the world.”

However most importantly, per Bloomberg yesterday, China has had each incentive to weaponize its $760 Billion (!) in US Treasury holdings.

And it could have executed so.

Let me begin with this graph, through Wolf Avenue, of the US Treasury yield curve:

That is virtually the worst configuration you possibly can think about. Not solely has the quick finish extra deeply inverted (traditionally a number one signal of recession), but in addition the lengthy finish has risen in yield (additionally a number one signal of recession in different fashions). About the one worse configuration can be if the Fed needed to increase rates of interest additional to fight inflation or to defend the US$.

Everyone knows that final week US Treasury yields rose sharply – by 0.40% from 3.99% to 4.40%, rising as excessive as 4.60% intraday:

This has had some speedy financial impacts, most notably on mortgage charges, which on Friday rose again over 7%:

That is virtually actually going to impression mortgage purposes and new housing gross sales and permits, hurting that vital main sector.

Moreover, spreads between US Treasury’s and funding grade company bonds have widened considerably (crimson), and the spreads of each in contrast with excessive yield speculative company bonds (gold) have widened as nicely:

That is sometimes an indication of economic stress and infrequently (however not at all times!) a brief main indicator of impending recession as nicely:

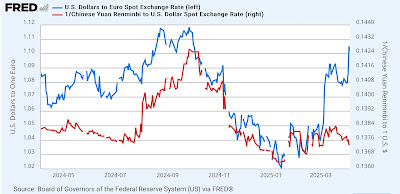

However as has already been famous in different corners, the sell-off within the bond market might additionally impression the standing of the US$. Here’s a graph of the US$ vs. the Euro (blue) and Chinese language Renminbi (crimson) over the previous 10 years:

Be aware that over that point the overall pattern was the strengthening of the US$ towards each currencies.

However now let’s give attention to the final yr:

On T—-p’s inauguration day, the Euro was virtually 1:1 parity with the US$. Since then the Euro has appreciated, and final week it gained one other 0.25 from 1.08 to 1.105 towards the greenback. In the meantime the Renminbi within the final a number of weeks has decoupled, depreciating in worth vs. the US$.

Why would the Renminbi lose worth? Possibly as a result of China was promoting US Treasury’s and shopping for different currencies.

Though I gained’t present the graphs, US Treasury’s haven’t been the one bonds that offered off final week. So did longer maturities in Canada, the UK, Japan, and Australia.

However two bonds conspicuously stood out, having sharp downtrends in yields.

One was all the bonds within the Euro space. Under I present Germany, however there are related charts for France and Italy (!):

So it seems to be like there was a transfer out of Treasury’s and into Euro space bonds.

However the different related graph was yields on Chinese language bonds, which usually can solely be traded internally in China:

So on the worldwide scale, US bonds as nicely of these of its closest buying and selling companions offered off, whereas Euro space and Chinese language bonds went totally within the different route.

As proven above, this prompted the Euro to understand towards the US$ – however not the Chinese language renminbi.

If this had been simply China humiliating T—-p, it could be value an excellent chuckle. However your complete US financial system is prone to undergo due to this transfer. T—-p will in all probability give up on this struggle, however rationality is just not his sturdy swimsuit. And Xi might want the US as a complete humiliated as nicely.

“Important changes in trend in the bond and stock markets, and a note on GDP estimates as well,” Offended Bear by New Deal democrat