Extract from Thomas Jefferson to “Henry Tompkinson” (Samuel Kercheval)

“I am not among those who fear the people. they and not the rich, are our dependance for continued freedom. and to preserve their independence, we must not let our rulers load us with perpetual debt . . . if we run into such debts as that we must be taxed in our meat and in our drink, in our necessaries & our comforts, in our labors & our amusements, for our callings and our creeds, as the people of England are, our people, like them, must come to labor 16. hours in the 24. give the earnings of 15. of these to the government for their debts and daily expences; and the 16th being insufficient to afford us bread, we must live, as they now do, on oatmeal & potatoes.” – Thomas Jefferson, Monticello July 12. 1816.

I’ve been writing on Indignant Bear about Scholar Mortgage “debt” and the lack of scholars, individuals to pay or relieve themselves of those loans in the identical vogue as a automobile mortgage, and so on. for years. One of many greatest instigators of the denial of the correct to chapter has been President Joe Biden. He has taken this stance for the reason that eighties. No politician can deny this from occurring.

Thomas Jefferson warned of our rulers loading the inhabitants with perpetual debt effectively after independence.

Federal Scholar Loans Completely, Positively, can be Cancelled

by Alan Collinge

The scholar mortgage cancellation debate has taken-on spectacular proportions since 2020 when Joe Biden made it a centerpiece of his presidential marketing campaign. Since then, we’ve seen all method of partisan preventing on this problem within the public dialog, in Congress, even within the Supreme Court docket.

What will get misplaced within the cacophony is an easy, unavoidable truth. The overwhelming majority of federal scholar loans won’t ever be repaid. The truth is, they are going to be cancelled.

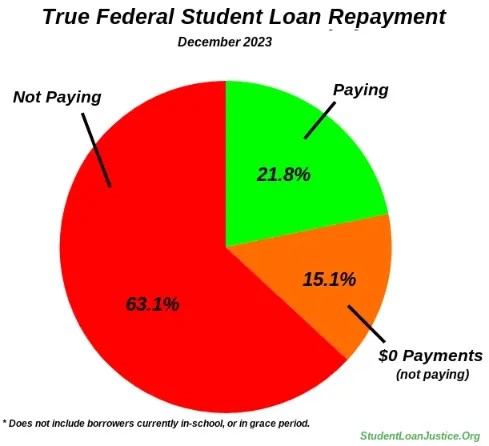

Even earlier than the pandemic, greater than half of all debtors have been unable to make funds on their loans. Right this moment, that quantity has shot as much as 78.2% (not together with college students who’re at present enrolled at school). That is more likely to enhance, not lower as the truth/issue of repaying the loans after a 3+ yr pause on funds sinks in for debtors.

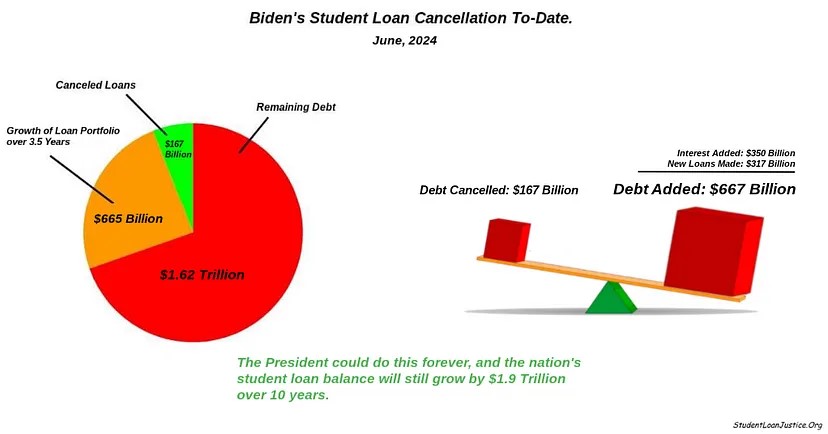

The President’s much-touted scholar mortgage cancellations are practically inconsequential. An evaluation reveals that even assuming this- or the next- President continued cancelling loans on the identical price. We’ve already seen ($167 billion each 3.5 years) the mortgage portfolio develop by practically $2 Trillion over 10 years. With solely about $20 billion being repaid from the debtors (this assumes a median $200/month cost from 8.8 million debtors), we’re nonetheless left with a portfolio development of about $1.7 Trillion over ten years.

It doesn’t matter what your opinion on the topic is perhaps, the overwhelming majority of the

debt can be cancelled, and that could be a truth that’s simply not up for debate.

The federal scholar mortgage program is, frankly, completed. All rational metrics bear this out. All of the “experts” in Washington DC know that is true. They noticed this coming a few years in the past, frankly. The one query, at this time, is whether or not we take care of this $1.7 Trillion downside now, or are confronted with over $3 Trillion in cancellations ten years from now.

Apparently, the taxpayers have primarily damaged even on the loans up thus far, having recouped practically as a lot as lent out underneath this system. The loans might be cancelled solely at this time, and the federal government could be breaking about even.

Previous efficiency, nevertheless, is not any assure of future results- definitely not on this case. The taxpayers will completely not recoup their funding going ahead. To proceed this failed mortgage program is strictly the improper transfer. Lending techniques fail on occasion, typically spectacularly. From The S&L disaster of the 80’s, to subprimes within the 2000’s, to the federal scholar mortgage program at this time. These failures have been acknowledged, and dealt with. An identical “Day of Reckoning” for the federal scholar mortgage program is right here.

The present political narrative round this downside (largely formed by those that want to perpetuate this failed mortgage rip-off) is an electoral bonanza for the Democrats. They’re cashing in on the actual hurt these predatory, hyper-inflationary loans are inflicting to 40 million voters, who comprise a proportional mixture of conservatives, liberals, and independents. By cancelling even small quantities of the debt, overselling these small acts, and wrapping all of it in nice sounding rhetoric, Biden and the Democrats (even when insincere) are enjoying the Republicans like a fiddle on this problem.

With each finger-wagging republican Congress member who excoriates the Democrats, denigrates the debtors, and insists (falsely) that the taxpayers are footing the invoice for these cancellations (they aren’t), the GOP solely pushes away 20% of their voting base who’ve scholar loans (80% are in misery about them), and tens of millions of independents for whom this problem is prime of thoughts.

This can get a lot worse for the Republicans, to say nothing of their base, who are actually killing themselves, declaring struggle on the Federal authorities, and committing probably the most ghastly of acts. No less than partly because of the psychological stress this failed, unconstitutional mortgage rip-off has placed on them.

What must occur:

Commonplace, Constitutionally enshrined chapter rights should be returned to the debt. The President ought to stand on the able to cancel very broad, deep swaths of the debt relying on the variety of filings, which might be very massive, and have to be pre-empted. The Founders known as for uniform chapter rights for an excellent cause, and tyrannical mortgage scams like what the federal scholar mortgage program has grow to be have been exactly what they needed to keep away from. However for the greed, corruption, conceitedness, and lack of honesty and political braveness in Washington DC, this might have occurred a very long time in the past.

Actuality is a cussed factor: The loans is not going to be paid, the loans can be cancelled. The earlier that is acknowledged, the earlier we are able to transfer ahead, finish, and substitute this failed mortgage rip-off with one thing that helps, slightly than damage, the overwhelming majority of people that make use of it.

For those who agree, please signal this petition.