The problem of the Tax Cuts expiring will probably be arriving at everybody’s doorstep come the top of 2025. They don’t give a precise date so i’ll go together with EOM December 2025. Does somebody making near or greater than $400,000 yearly deserve a continuation into 2026 and past? Unsure. I feel the 1 percenter needs to be paying extra tax.

My spouse and I paid some excessive taxes (what we might name excessive) after we have been beneath $200,000 yearly after deductions. That was close to the top of our careers so this was not life-style altering for us. Trump tossing a tax break to the one percenter by to the one-tenth of 1 percenter has to return to an finish.

It ought to have additionally occurred with the Bush tax breaks. They didn’t and Trump simply added to the pile of deficit spending if that’s your fear.

In Consolation Oshagbemi and Louise Sheiner’s commentary “Which provisions of the Tax Cuts and Jobs Act Should Expire in 2025?” they reply the query on the finish by offering a good thing about letting it expire after some modifications.

Finest to learn by . . .

The Tax Cuts and Jobs Act (TCJA) of 2017 included important modifications to the tax code. Many of those modifications have been to be on non permanent foundation and have been to run out on the finish of 2025. Former President Donald Trump favors extending all of the expiring provisions. Vice President Kamala Harris hasn’t been particular, however says she opposes any tax will increase on individuals making lower than $400,000, which suggests extending some provisions of the TCJA.

That are probably the most important expiring provisions?

Customary deduction: The TCJA elevated the usual deduction and eradicated private exemptions. For instance, if the TCJA expires as beneath present legislation, the usual deduction for a married couple will probably be roughly $16,525 in 2026, whereas the non-public exemption will probably be about $5,275. If this provision of the TCJA have been prolonged by 2026, the usual deduction can be roughly $30,725, and the non-public exemption can be zero.1

Particular person earnings tax charges: The TCJA lowered marginal earnings tax charges all through a lot of the earnings distribution. For instance, the TCJA reduce the highest marginal tax charge from 39.6% to 37%. These charges will improve to pre-2017 ranges if the TCJA expires.

State and native tax (SALT) deduction: The TCJA imposed a $10,000 cap on the deductibility of state and native taxes (SALT). If this provision of the TCJA expires, all state and native property taxes and earnings taxes (or gross sales taxes in states with out earnings taxes) will probably be deductible, primarily benefiting high-income taxpayers in high-tax states.

Baby Tax Credit score: The TCJA will increase the tax credit score for every baby beneath 17 from $1,000 to $2,000. This isn’t adjusted for inflation. The utmost credit score that may be refunded elevated from $1,000 to $1,400 per baby in 2018; that’s adjusted for inflation and is about at $1,700 in 2024. The TCJA additionally elevated the earnings thresholds at which the credit score phases out. The kid tax credit score will fall again to $1,000 if the TCJA expires, which might make the true worth of the credit score about 25% decrease than it was in 2017.

Deduction for small enterprise earnings: The TCJA supplied a 20% deduction for certified pass-through earnings (part 199A) for sole proprietorships, partnerships, and S-corporations. If the TCJA expires, this deduction will now not be accessible.

Different minimal tax (AMT): The TCJA elevated the AMT exemption quantities and raised the earnings ranges at which the exemptions part out, leading to fewer taxpayers answerable for the AMT. If this provision of the TCJA expires, the 2026 AMT exemption for married {couples} submitting collectively will probably be about $110,075, in comparison with about $140,300 if the availability is prolonged.

Property taxes: The TCJA doubled the property tax exemption. If this provision expires the exemption in 2026 will probably be about $14.3 million for married {couples}, in comparison with $28.6 million if the availability is prolonged.

Which provisions of the TCJA weren’t enacted on a brief foundation?

Company provisions: Many of the TCJA’s provisions that have an effect on firms—together with the discount within the company tax charge from 35% to 21%— don’t sundown. One exception is the availability that permitted a 100% bonus depreciation deduction for property with helpful lives of 20 years of much less. This deduction started phasing out in 2023 and will probably be totally phased out by 2026.

Particular person and property provisions: Many of the provisions affecting people and estates do sundown. One exception is the change within the inflation adjustment methodology. This was enacted on a everlasting foundation. Particularly, the IRS is now required to make use of the chained CPI-U fairly than the CPI-U to index the assorted provisions of the tax code which can be inflation-adjusted—together with the tax brackets and the usual deduction. The chained CPI-U usually rises extra slowly than the CPI-U, leading to elevated tax revenues.

How a lot extra income is raised by the expiration of the TCJA’s particular person tax insurance policies?

In Might 2024, the Congressional Funds Workplace estimated that the expiration of the TCJA’s particular person tax provision would increase authorities revenues by $4.6 trillion from FY2025 – 2034, about 1.3% of projected GDP.

What are the distributional impacts of permitting the TCJA’s provisions to run out?

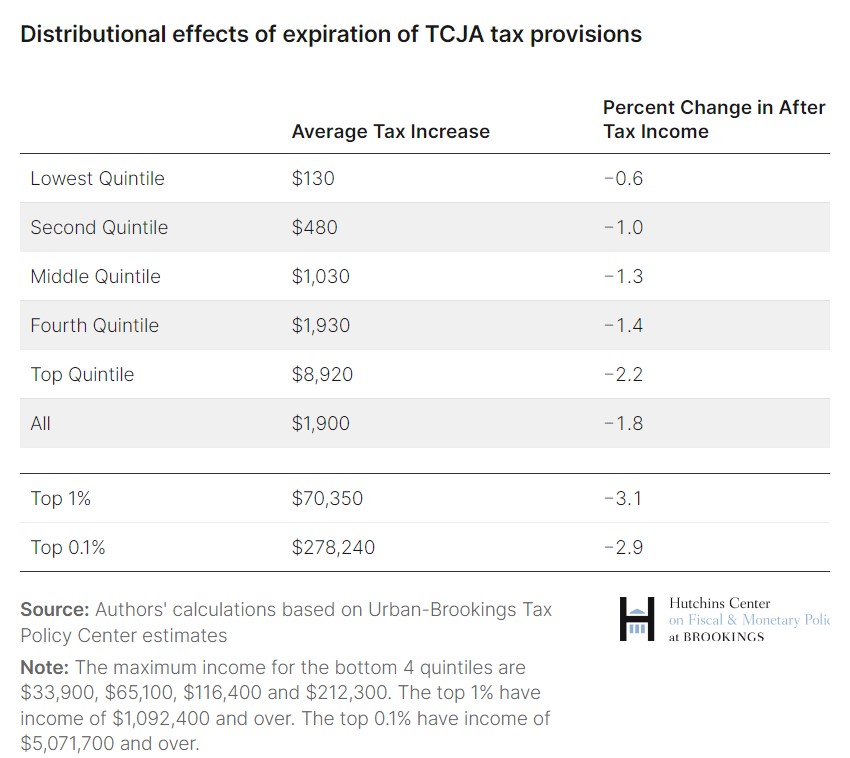

The TCJA supplied the most important advantages to the richest taxpayers, and so the expiration of a lot of its provisions will disproportionately have an effect on the wealthy. The desk beneath reviews estimates from the Tax Coverage Heart of the distributional results of the expiration of the TCJA provisions.2 Households within the lowest earnings quintile can pay roughly one-half p.c extra of their earnings in taxes if all of the provisions of the TCJA expire, whereas households within the prime 1% can pay a further 3.1% of their earnings in taxes.

Distributional results of expiration of TCJA tax provisions

1. For all of the calculations on this explainer, we assume that the CPI-U rises at a 2.5% annual charge although August 2024, and at a 2% annual charge thereafter.

2. The TPC tables report the consequences of extending the tax provisions; we recalculate the p.c change in after-tax earnings in order that it displays the consequences of permitting them to run out relative to extending them.

The sunsetting of the Tax Cuts & Jobs Act: What federal staff have to know, Authorities Govt

2017 Tax Breaks and Jobs Act Did not Ship, Offended Bear

Wanting on the Trump 2017 Tax Breaks and Extension of them, Offended Bear